Uncategorized

forex forecaster: Weekly Forex Forecast Forex Market Predictions This Week

Содержание

Despite today’s early strength, gains are being limited by hawkish comments from Federal Reserve Chair Jerome Powell’s message that interest rates would have to go higher and possibly faster. Fibonacci extension of the 2021 advance, the 2022 swing high and the 2020 March reversal close. A breach / weekly close above this threshold would be needed to mark resumption of the broader 2021 advance. Different suppliers of this technology will offer various features and software functionality. Some versions of the software are available online for free, and many brokerages provide a version of this software for their clients. Skylar Clarine is a fact-checker and expert in personal finance with a range of experience including veterinary technology and film studies.

Weekly Forex Forecast (February 27-March 3, 2023) – Daily Price Action

Weekly Forex Forecast (February 27-March 3, .

Posted: Fri, 03 Mar 2023 08:00:00 GMT [source]

The pause in the US Dollar recovery momentum provided the much-needed respite to the Pound Sterling bulls in the past week. The GBP/USD pair also cheered the Brexit deal announcement amid a week dominated by economic data from the United States. EURUSD is preparing to leave the descending channel; GOLD has secured above the resistance level, USDJPY is correcting before developing a bullish move. AUDUSD is preparing to break through the support level; USDCAD is correcting in a Triangle pattern, USDCHF is pushing off the lower border of the Cloud. A rebound from 6/8 will indicate growth of the USDCHF, gold quotes might correct to 2/8.

CRYPTOCURRENCIES

GOLD is forming a wave of decline; NZDUSD is developing a correction, GBPUSD is winding up a pullback. Therefore, in order to purchase investments in the yearned country, an investor would have to purchase the country’s currency. This creates an increased demand that should eventually cause the currency to appreciate. The same will happen due to another factor that may draw the investors’ attention – interest rates.

A sentiment indicator which delivers actionable price levels, not merely “mood” or “positioning” indications. Traders can check if there is unanimity among the surveyed experts – if there is excessive speculator sentiment driving a market – or if there are divergences among them. When sentiment is not at extremes, traders get actionable price targets to trade upon. When there is deviation between actual market rate and value reflected in forecasted rate, there is usually an opportunity to enter the market. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

USD/JPY Mid-Day Outlook

By Skerdian Meta, Lead AnalystAs risk currencies, both the CAD and the INR behave similarly when the sentiment in the markets is positive or negative. By Arslan Butt, Index & Commodity AnalystThe GBP/AUD has been moving in a bearish trend since last March 2020. A year ago, its prices were at 2.086 level, and now it has reached…. ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. The Forex Forecaster indicator would serve as the initial trend reversal indication.

This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. A forex trading bot or robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time. There are a number of existing AI-based platforms that try to predict the future of all Forex and metal markets.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This approach looks at the power of economic growth within various countries, in order to make a currency market forecast concerning the direction of exchange rates. The logic behind this approach is that a powerful economic environment and high growth has a bigger likelihood of attracting foreign investors.

Ichimoku Cloud Analysis 06.03.2023 (EURUSD, XAUUSD, USDJPY)

Traders should move stop losses to breakeven whenever possible and trail stop losses in order to protect profits. Aside from the bars, this indicator also provides trade entry signals by placing arrows on the price chart whenever it detects a trend change. Blue arrows pointing up indicate a bullish trend, while red arrows pointing down indicate a bearish trend. The arrows appear on the second bar that displays the same color. In a way, this indicator provides trade signals on a confirmed trend reversal by waiting for the second bar to confirm the trend change.

By Skerdian Meta, Lead AnalystThe Euro has been on a bearish trend against the US Dollar since 2008, and many analysts have predicted parity for the EUR/USD… For a look at all of today’s economic events, check out oureconomic calendar. Investors will closely watch the Fed’s updated “dot plot” of rate expectations at March’s meeting for further indications of how high Fed officials expect to raise rates.

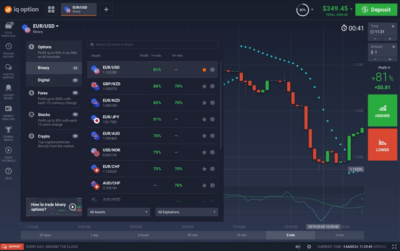

We aims to be a place where every forex traders can gain resources about trading. Forex forecasting software is an analytical toolkit used to help currency traders with foreign exchange trading analysis through technical charts and indicators. Forex forecasting the research driven investor software, while not guaranteed to be entirely accurate, makes it easier to apply technical analysis and make short-term predictions about the market’s direction. This information is helpful to individual traders looking to minimize losses and maximize profits.

The reason for utilising this method is based on the idea of using past behaviour data and price patterns to predict future price behaviour. Based on this principle, the PPP approach of forecasting Forex predicts that the exchange rate will change to counteract changes in prices, and this is due to inflation. For instance, let us suppose that prices in the US are anticipated https://forexbitcoin.info/ to increase by 4% over the next year, whilst prices in Canada are expected to rise by only 2%. We would like to show you how you can forecast the Forex market by exemplifying Forex forecasting methods. It is quite a challenging task to generate a forecast of good quality, but we will describe four methods of doing so based on a level of high proficiency.

The first method used by Forex forecasters is technical analysis. This website includes information about cryptocurrencies, contracts for difference and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. This trading strategy works well as a trend following trading strategy.

Natural Gas, WTI Oil, Brent Oil – Oil Pulls Back From Session Highs As Traders Focus On Recession Risks

Hawkish policy outlooks from Bullard and Mester , on top of more strong economic reports, added to the selling pressures in Treasuries and on Stocks… Spot gold remains above the 100 and 200-day MAs despite yesterday’s selloff. The best strategy for one person could be the worst one for others. There are several questions that need to be answered ahead of defining it. “Support and Resistance Lines conform the most basic analytical tools and are commonly used as visual markers to trace levels where the price…”

- The logic behind this approach is that a powerful economic environment and high growth has a bigger likelihood of attracting foreign investors.

- Forex charting software helps traders analyze foreign currency pairs price trends, enabling them to make informed trading decisions.

- We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

For 2023, returns will be helped by a higher starting running yield, and subsequent falls in market rates. EURUSD is testing the support level; GBPUSD is pushing off the signal lines of the indicator, USDJPY is correcting after a rebound off the upper border of the bullish channel. Thus, the inflation difference between these two countries is 2%.

Get the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 26th, 2022 here. Get the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of march 5th, 2022 here. USD/JPY looks to key economic data tomorrow in conjunction with the Bank of Japan interest rate meeting. Every learning process is evolutionary and requires the right steps to be followed in order to obtain knowledge and develop skills. A forex strategy is a combination of tools that should result in a positive balance in a certain period of time. During the creation of a strategy, flexibility and imagination are very important values.

This method is perhaps the most popular one due to its inclusion in economic textbooks. The PPP forecasting technique is rooted in the theoretical ‘Law of One Price’, which in fact states that identical goods in various countries should have identical prices. That also implies that there should not be any arbitrage opportunities for someone to buy something cheap in one country, and then sell it in another in order to gain profit. A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs.

High interest rates will undoubtedly attract investors looking for the highest yield on their investments, causing demand for the currency to increase. On the other hand, low interest rates may result in investors avoiding investing in a country, or alternatively borrowing the currency of the country with low interest rates, to fund other investments. A considerable amount of factors and statistics are applied in order to predict how certain events will affect supply and demand, along with rates in the FX market. This method shouldn’t be regarded as a reliable factor on its own, though it can be used in line with technical analysis to form an opinion about the various changes in the FX market. When entering the Forex market, it’s better to come prepared – and that’s where Forex forecasting comes into play.

Stocks: SP500, AAPL, AMZN, NVDA, TSLA, GOOGL, BRK.B, SQ, META

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Forex charting software helps traders analyze foreign currency pairs price trends, enabling them to make informed trading decisions. Most forex brokersallow you to open a demo account before funding a standard or mini account. This try-before-you-buy option will enable users to try out each broker’s software during a trial period and determine which software and broker best suit their needs. The goal is to automate identification of technical indicators or chart patterns across a range of currency pairs in order to identify trade entry and exit points. This indicator indicates trend direction by displaying bars on the price chart, which is based on the Exponential Moving Average .

“Advisory Opinion, comprised of arguments and trade ideas which have been committed to publication and therefore have an influence on the trading public, are considered a sentiment indicator.” For a comprehensive overview of where key markets might be headed next, and to take advantage, download one of our quarterly forecasts for major FX pairs, commodities and equities. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. We also indicate the average price forecast as well as the average bias. The #FXpoll is not to be taken as signal or as final target, but as an exchange rates heat map of where sentiment and expectations are going. The Forex Forecast Poll is a sentiment tool that highlights near- and medium-term price expectations from leading market experts.

For those who trade Forex, knowing the techniques of how to forecast the FX market can be the resounding difference between those who trade successfully, and those end up losing money. As soon as you start to learn about Forex trading, you should also start learning how to forecast the FX trading market. This article has been prepared with the purpose of helping you to learn the basic Forex forecasting techniques, and how to apply them in your FX trading. Dollar on Thursday after hitting its lowest level since January 6 the previous session.

Traders make money by picking the right direction at the right time. Those who have mastered the art of getting these two things right stand to make a lot of money in the forex market. However, getting these two things right might be harder than it looks. Gold finally broke out of the consolidation after being range bound for nearly 11 days. The correction to the downside was expected as gold traded in the overbought territory…

Forecasting in FX means predicting current and future market trends by utilising existing data and various facts. Being an analyst, one should rely on both fundamental and technical statistics in order to predict the directions of the economy, the stock market, and individual securities. Investments involve risks and are not suitable for all investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider.